FAQs

Frequently Asked Questions

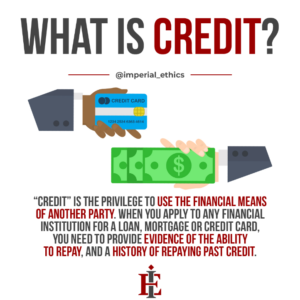

Credit is generally defined as a contract agreement in which a borrower receives a sum of money or something of value and repays the lender at a later date, generally with interest.

Having a great credit score comes with plenty of benefits. From higher credit card limits, not having a down payment when purchasing a vehicle, free plane tickets when signing up for certain credit cards, more cash back on credit cards, no security deposits when renting an apartment, being approved to live in luxury apartments, no security deposit for utilities, and more loan options for purchasing a home. Did you know there is a first time home-buyers program that will pay for majority of the down payment when purchasing a home? YES!!! Good credit can also help when applying for a job.

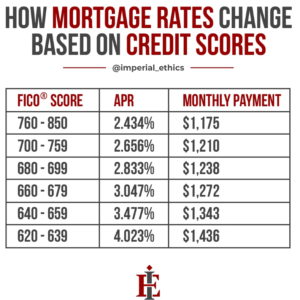

The cost of credit repair versus the cost of having bad credit doesn’t compare. The cost of having bad credit can cost HUNDREDS of THOUSANDS of dollars over a lifetime. In the chart below, the difference between having a great credit score and a fair credit is about 1.5 pct in interest for a mortgage. The person with a higher interest rate pays $261.00 more a month. Over the lifetime of the loan, that is $93,960.00. This is just for a home. There are higher interest rates on credit cards, vehicles, higher insurance premiums, security deposits for apartments, security deposits for utilities, etc when you have a lower credit score.

The cost of our credit repair service is very affordable and will probably cost less than your cell phone service each month. More times than not, the cost of credit repair isn’t even close to the balances owed on someone’s credit report. Most of our competitors have a sign up fee between $100-$250. Ours is free. Most of our competitors have a fee to do an analysis and a consultation. The consultation and analysis is free as well. Our first month is free and any lawsuits made by the attorney we partner with is free. We are so confident in our services, there is a 90 day money back guarantee. Credit repair is an investment in yourself, and your future self will thank you for it.

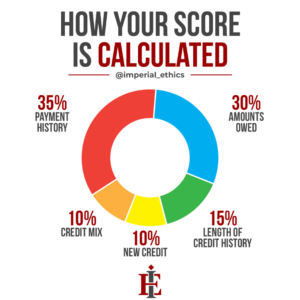

While making payments on time is very important, payment history only makes up 35 percent of a credit score. Here is a breakdown of how your credit score is calculated.

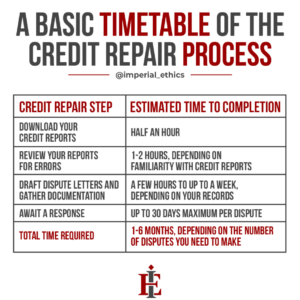

It really is a case by case basis. Some people need more assistance than others. Here is a BASIC timetable of how long the process can take:

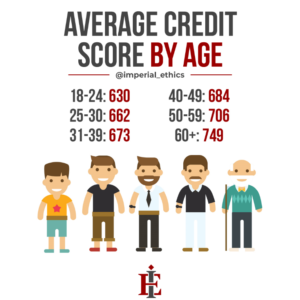

Here is a chart that breaks down the average credit score by age:

Your credit cards, vehicle loans, personal loans, etc have DAILY INTEREST. Every single day you wait to repair your credit, that is more money going from your pocket to the banks or financial institution. When you have a good credit score, you are able to renegotiate interest rates, which means more money in your pocket.